Table of Contents

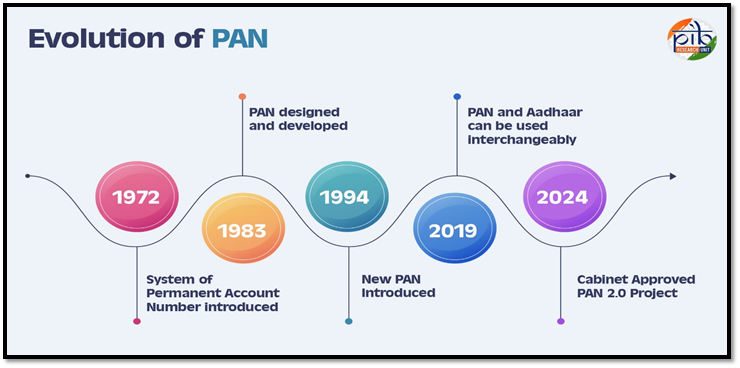

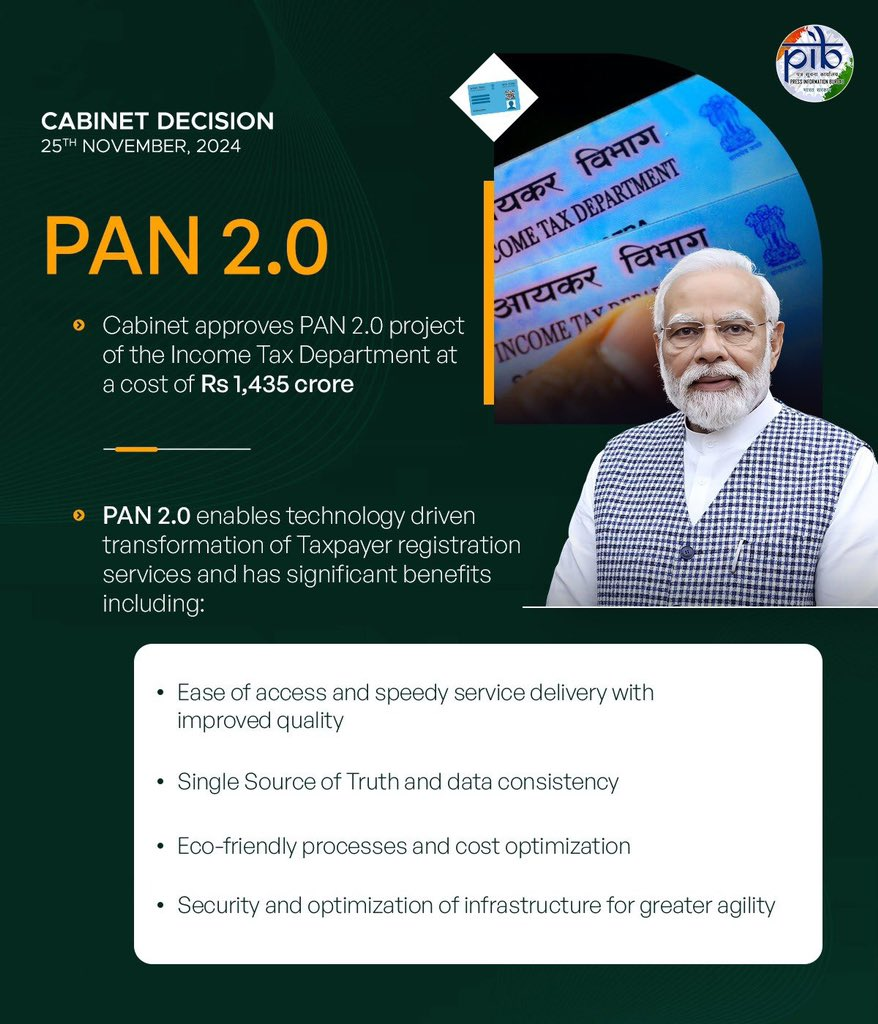

The Permanent Account Number (PAN) plays a key role in India’s financial framework. It links individuals and businesses to crucial services and monitors financial transactions. With the aim of simplifying usage, the government has rolled out PAN 2.0. This updated platform seeks to enhance the functionality of PAN in our digital era.

What is PAN 2.0?

PAN 2.0 is a project that changes how people register for their PAN. Why is it great? Well –

- One Simple Portal: You will access all PAN/TAN-related services from one website.

- Go Paperless: It will cut down paper use, which helps our nature.

- Free PAN Issuance: You’ll get your PAN free and quick.

- Better Security: Your personal information will be safer with improved data security.

- Help When You Need It: A special call centre will be available for any of your queries.

New PAN 2.0 Vs Old System

PAN 2.0 is designed to simplify things by bundling all PAN/TAN services in a single unified location. Let’s glance over some main characteristics:

- All Services in One Place: Currently, you have to visit different websites (e-Filing Portal, Protean e-Gov Portal, and UTIITSL Portal), for different services related to PAN. Now, everything will be available on the Income Tax Department’s website. This includes applying for a new PAN/TAN, updating your details, or linking your Aadhaar number.

- Online and Paperless: You will be able to complete all processes online without using paper.

- Free Services: You won’t have to pay anything for getting or updating your PAN online. If you want a physical PAN card, there will be a small fee of ₹50 for domestic requests and ₹15 + India post charges at actuals will be charged for delivery outside India.

About Current PAN Cardholders

If you already have a PAN card, there’s no need to worry! Your current card will still work under the new system unless you want to change something. You won’t get a new card unless you ask for an update.

New QR Code Feature in PAN 2.0

PAN cards will now include a new QR code that makes it easier to verify your information:

- The QR code has been on PAN cards since 2017 but will now show updated information directly from the database.

- If your old card doesn’t have a QR code, you can apply for a new one.

- Scanning the QR code will show important details like your name, photo, parents’ names, signature and date of birth.

Who Needs a PAN and TAN?

You need to get a PAN if:

- Your total income is more than the tax-free limit set by the government.

- You run a charitable trust that needs to file tax returns.

- Your business or profession has sales or income exceeding ₹5 lakh in a year.

- You plan to enter into financial transactions where quoting your PAN is required.

- If you are not an individual but are involved in financial transactions over ₹2.5 lakh during the year.

You need to get a TAN if:

- The Tax Deduction and Collection Account Number (TAN) is another important number issued by the Income Tax Department.

- It is required for businesses that collect taxes on behalf of the government (like TDS).

- If you don’t obtain or quote your TAN correctly, there could be penalties.

Conclusion

The PAN 2.0 Project boosts India’s tax system into the digital age. It’s a user-friendly, online system with top-notch security. Its goal? To assist folks with tax duties in a snap! This project isn’t just about ease—it’s about safety too. You can trust that your info stays locked away! So now, following tax laws and helping India’s governance just got a whole lot simpler.

References:

https://pib.gov.in/PressReleasePage.aspx?PRID=2077104

https://pib.gov.in/PressNoteDetails.aspx?NoteId=153464&ModuleId=3®=3&lang=1

https://pib.gov.in/PressReleasePage.aspx?PRID=2077608

FAQs

The PAN 2.0 system’s primary goal is to improve how taxpayers & businesses in India are served. It does this by refining and updating the PAN/TAN system. This project, a piece of the government’s Digital India drive, hopes to establish a unified digital platform. This platform is for all services related to PAN/TAN, simplifying the process for people and businesses to handle their taxation data.

PAN 2.0 makes it easier for taxpayers to sign up. It gathers all PAN/TAN services on single unified portal run by the Income Tax Department. This means you can apply for and get your Permanent Account Number (PAN) super fast, often in minutes.

No need for piles of paperwork. The 2.0 system check documents quickly and precisely, getting rid of errors and bounced back applications. Each PAN card has a quick-check QR code on it. And the whole process is paper-free, which is good for being efficient and for the environment. With live updates on application status, PAN 2.0 makes things clear and more user-friendly for taxpayers.

PAN 2.0’s rollout might hit some bumps. Tech hitches, like clogged servers or bugs, could slow things down. They might cause issues with tax info, making things tough for users. Then there’s the problem of getting old systems up to speed. Mixing new tech with old data might cause some mix-ups while everything gets settled.

Data protection and privacy come into play too, given the vast amount of sensitive financial data at stake. After all, it could evoke worries over data leaks and misuse. Not to mention, the initial setup and continual upkeep of high-tech infrastructure could strain government funds. Taxpayers may also feel the pinch, especially smaller businesses and ordinary folks trying to navigate the unfamiliar system.

Certainly, folks in rural locations or those less tech-savvy, like senior citizens, could struggle to use new internet platforms. This could spark a digital gap. In addition, extra peeking and tracking might make taxpayers nervous due to fear of too much government supervision in their financial life. Solving these hurdles will be key for PAN 2.0 to be adopted well.

Last modified: December 1, 2024